Sanchayapatra Services

In Bangladesh, Sanchayapatra (also known as savings certificates; savings instruments) are widely regarded as risk-free investments. It’s a kind of savings mobilization scheme of the Government of the People’s Republic of Bangladesh. Recently Department of National Savings and Bangladesh Bank jointly automate the Sanchayapatra Purchase & Encashment.

Any Bangladeshi citizen can buy the appropriate Sanchayapatra conforming to the rules and regulations imposed by the Government. To purchase Sanchayapatra from IFIC Bank you will require to have an IFIC account.

Please visit the websites of Department of National Savings or Bangladesh Bank to know more about Sanchayapatra, plans, eligibility and other criteria.

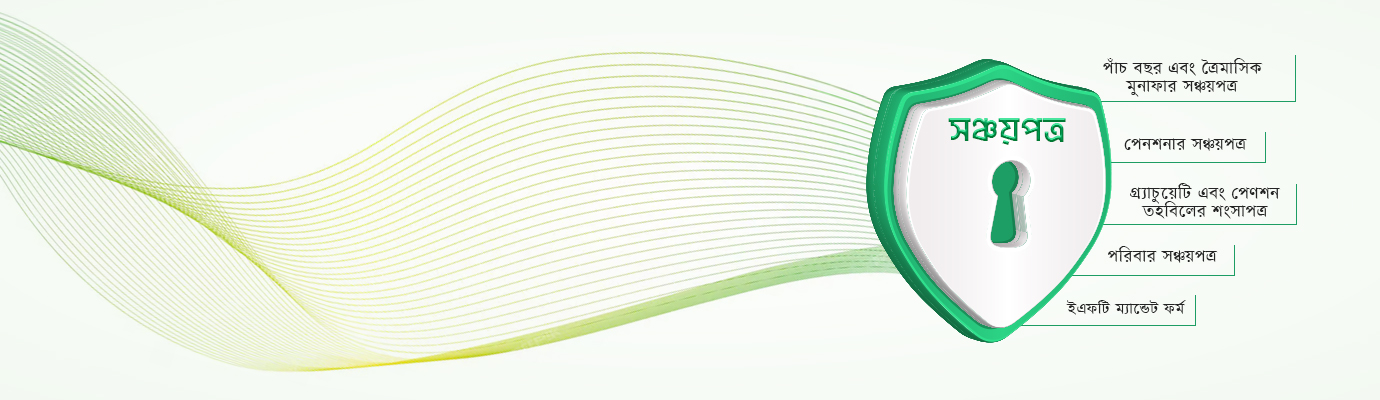

Sanchayapatra types:

- 5 Years & 3 Monthly Interest bearing Sanchayapatra

- Pensioner Sanchayapatra

- Certificate for gratuity and pension fund

- Poribar Sanchayapatra

- EFT Mandate Form

|

Key features of the existing National Savings Schemes. Key Features of NSS-2012 |

|||||||||||||||||||

|

Sl. |

Name of |

Maturity |

Limit |

Interest rate |

Tax |

Investors |

Penalty |

Implementing |

|||||||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|||||||||||

|

1. |

5 years |

5-Year |

Single: 30 lac; |

13.19% on Maturity |

5% |

All classes |

Encashment |

Bank, Bureau & |

|||||||||||

|

2. |

3-Monthly |

3-year |

Single: 30 lac; Jointly: 60 lac; |

12.59% on Maturity |

5% |

All classes |

Encashment |

Bank, Bureau & |

|||||||||||

|

3. |

Pensioner |

5-Year |

50 lac |

13.19% on Maturity |

5% |

Retired Govt., Semi-Govt, Autonomous, Semi-Autonomous officials. |

Encashment |

Bank, Bureau & |

|||||||||||

|

4. |

Poribar |

5-Year |

45 lac |

13.45% on Maturity |

5% |

Any Adult Bangladeshi (National ID Card Holder) |

Encashment |

Bank, Bureau & |

|||||||||||